The Only Agentic AI Mortgage POS+

We turn tasks into actions.

The AI tidal wave is here and businesses are already being disrupted, whether they realize it or not. Those, who take advantage of its capabilities, will lead. Those who don’t risk becoming irrelevant if not obsolete.

IMB, bank and credit union features

Our features help you grow.

Agentic AI is our core

Deliver productivity and enhance user experiences while analyzing structured or unstructured data and automating repetitive tasks.

Multilingual

Borrowers can self-select a preferred language loan inquiry to deliver the application, emails, texts and interactive Q&A in that language. English and Spanish are available with plans to offer over 30 language options.

Convert voice and more into applications

Take any e-communication or transcription and start the application. Our interactive voice response (IVR) allows you to record a phone call (with permission), parse the conversation, and start the application.

Self-directed, instant prequalification

Tidalwave is DU® and LPA℠ enabled, so you have the option to allow your borrowers to generate their own verified pre-qualification letters without assistance.

Hallucination-free

Our patent-pending mortgage contextualizer ensures communication with Tidalwave’s AI is hallucination-free.

Run dual AUS

Simultaneously run Fannie Mae’s DU® and Freddie Mac’s LPA℠ at the point of application, giving lenders an advantage as they can compare findings and truly select the best outcome for their borrowers.

How can our features positively impact you?

Tidalwave flips borrower perceptions that mortgage applications are hard and removes originators’ redundant tasks.

We help financial institutions grow.

Features that a legacy mortgage point-of-sale system delivers to your IMB, bank or credit union do not often deliver ROI. That’s not the case with our Mortgage POS+ solution. We only provide features that drive benefits for you and everything is built by our industry-changing team. Tidalwave’s combination lets you enhance mortgage originator efficiencies, close rates, and profitability.

Eliminate mundane and redundant tasks

Manual letters of explanation, credit inquiries of explanation, and large deposit letters of explanation all become things of the past.

Our AI balances automation with human interaction

Tidalwave’s agentic AI platform allows you to easily create your Financial Institution’s (FI) personalized AI Assistant for different functions.

Extend your market share

Having the opportunity to take inquiries in Spanish and soon dozens of languages along with applications in English allows you to dramatically increase the number of potential borrowers.

Automate condition mapping and task tracking

Tidalwave’s AI understands underwriting systems and loan origination system conditions, knows which documents are needed, and automatically adds them to your borrower’s task list.

Leading mortgage loan origination system integrations

Tidalwave only uses the latest APIs in our existing integrations (ICE / Encompass, MeridianLink, and Calyx Path). Additional mortgage LOS partnerships are being negotiated.

Receive push notifications

Tidalwave’s native mobile app allows loan officers to receive real-time borrower communications and status updates which expedites the application process.

Our team

We fundamentally changed an industry once. Now we’re doing it again.

Diane Yu

Founder, CEO

Ex-CTO Better, Ex-CTO Comcast Ads, Founder FreeWheel, Ex-DoubleClick / Google, Board Member Magnite (NASDAQ: MGNI)

Jack Deng

Founder, CTO

Ex-Better, Ex-Comcast, Ex-Chief Architect FreeWheel

Cheng Li

Founder, Eng & Ops

Ex-Better, Ex-Google, Ex-FreeWheel

Chris McLendon

CRO

Ex-ICE / Encompass, Ex-Black Knight

Chris Olsen

Sales Engineering

Ex-nCino / SimpleNexus, Ex-ICE / Encompass

Stephanie Selig

Compliance and Mortgage Ops

Ex-Better, Ex-Landis

Shawna Adams-Johnson

Professional Services & Implementation

Ex-ICE / Encompass, Ex-KensieMae, Ex-nCino / SimpleNexus

Want us as part of your mortgage team?

Imagine if there was a way to convert more mortgage applications into funded loans and reduce originator redundancies. Our team did!

We help convert more applicants into borrowers.

Tidalwave enables IMBs, credit unions and banks to gain market share as our agentic AI Mortgage POS+ simultaneously places originators and borrowers at the center of your mortgage application process. This allows you to eliminate key problems borrowers have in the application process.

Reduced application anxiety

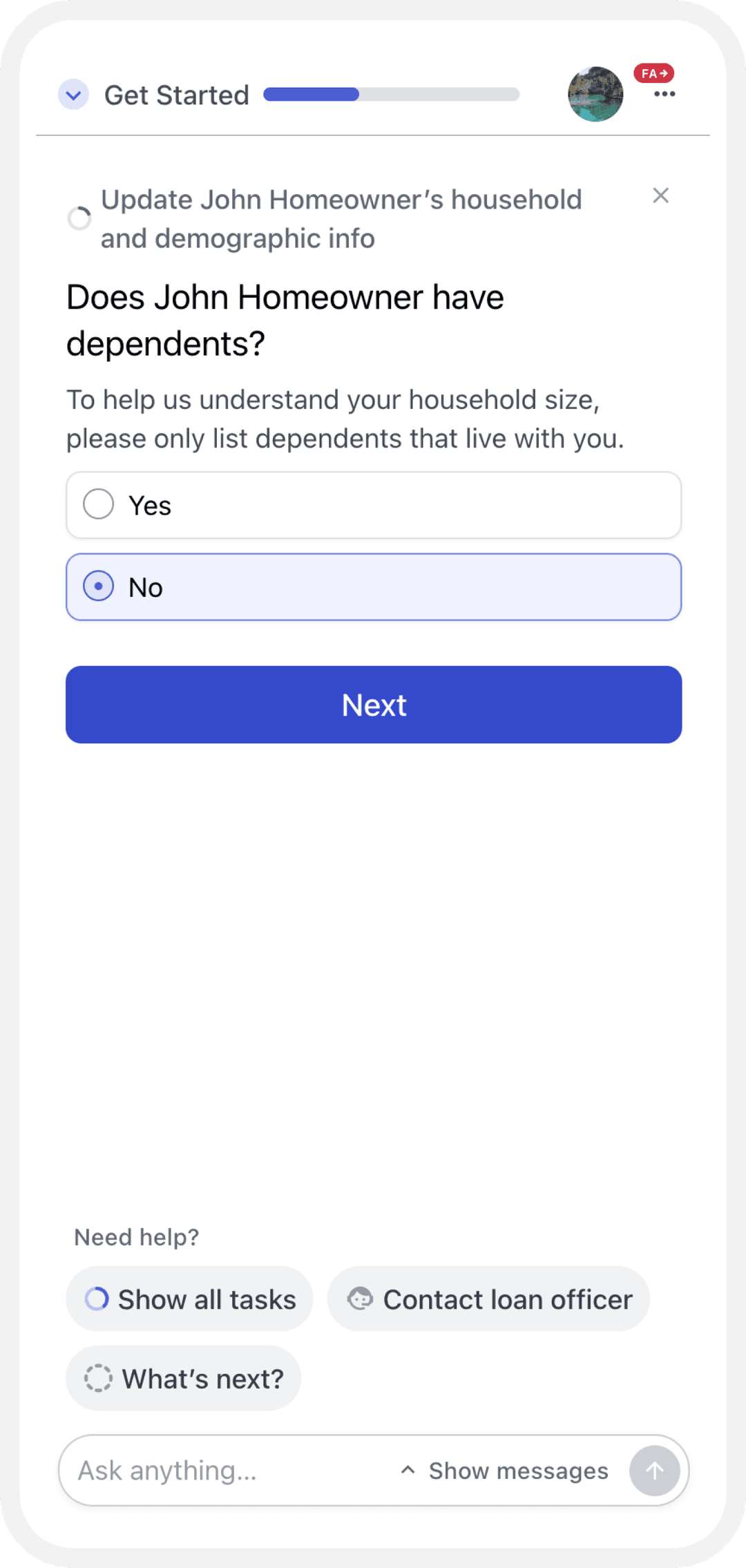

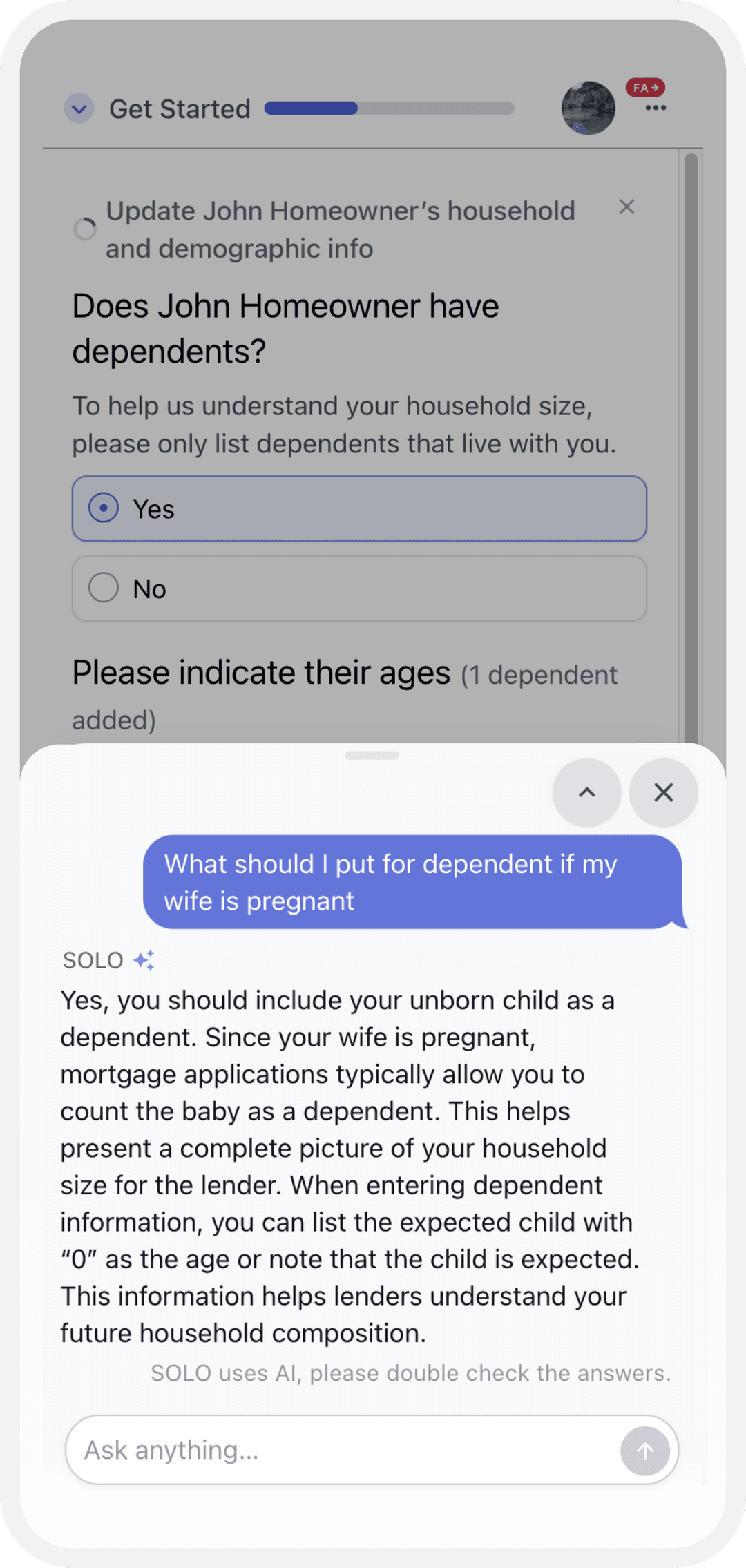

Our AI hybrid chat and questionnaire-based workflow guides borrowers through the application process and accurately responds (no hallucinations) in real-time, any time.

Reduce fraud

Our encrypted digital platform provides secure document storage and transmission; resulting in stronger security.

Reduce unnecessary document uploads

Our AI is deterministic which reduces borrower task lists as it’s a personalized application process every time for every borrower.

Reduce time to approval

Tidalwave is integrated with Plaid, Argyle, Truv, and AccountChek so borrowers do not have to manually upload documents which reduce timelines.

Native, lender-branded mobile app

Our Mortgage POS+ is seamless to your brand which enhances the likelihood that borrowers complete the application. Loan officers can also respond to questions due to received push notifications.

Customer validation

Jesse Lopez

VP, Process Improvement

Mortgage Solutions Financial

“By eliminating the manual grind for our loan officers, Tidalwave’s AI-powered platform allows them to double down on what matters most — building relationships and closing loans. The speed, efficiency, and precision it brings to our origination process has elevated both our internal operations and the client experience. It’s not just a tech upgrade — it’s a strategic advantage that we believe will help us attract top talent and stay ahead in a highly competitive market.”

Tracy Marks

CEO

MPower Mortgage

“Tidalwave sets the standard in mortgage technology. Their responsiveness and partnership let us move fast, implement with ease, and stay on pace with our business. The platform is best in class, streamlining workflows, boosting collaboration, and delivering an outstanding experience for our borrowers. It’s efficiency and engagement on a whole new level.”

Taylor Stork

COO

Developer's Mortgage Company

“Tidalwave’s AI innovation has us genuinely excited about where we’re heading as a mortgage technology leader. What I appreciate most is how intuitive it is for loan officers to assist borrowers, every team member can see the full picture in real time, making the lending process completely transparent and effortless. It’s a game changer both for our staff and our customers.”

Paige Hagerhorst

SVP, Operations & Information Technology

GNB Mortgage

“Making AI accessible to more lenders is a game changer – we’re going to see mortgages become faster and more affordable. Going live with Tidalwave’s SOLO™ allows us to streamline the workflow and reduce overhead, giving us a real competitive edge while lowering the cost of originating loans.”

Want the AI Mortgage POS+ experience they love?

Let your team achieve those satisfaction levels.